Very financial institutions allows you to deposit money orders and cashier’s monitors by using the cellular put element. Although not, you may need to endorse the brand new view and make “to possess mobile deposit simply” on the rear ahead of distribution they from mobile software. Ally also offers effortless, totally free and you may safer online view dumps due to Ally eCheck℠ Deposit. If you’ve been a friend customer for over 29 weeks, you’re going to get far more immediate access to the currency which is helpful if you would like create swift money.

Comment and you will indication the view

If you individual a leading account, those people restrictions increase in order to $25,one hundred thousand per day and $50,one hundred thousand a month. The newest Federal Put Insurance policies Firm (FDIC) is certainly https://playcasinoonline.ca/discover-card/ recording the fresh decline from papers monitors over the earlier long time. At the same time, the new Government Set-aside Bank from Atlanta has just showed up that have a good statement saying anyone just share around three checks a month for the average.

If you have more than 3 months of history, one to count expands so you can $ten,one hundred thousand. SoFi and you will Chime both frequently offer this type of bonuses after you indication right up. Cellular Look at Deposit try a great free1 solution on the Citi Cellular Software to possess new iphone 4 and you may Android™ devices. Hold the actual search for two weeks in case of people difficulties with the new put. Using a current version will assist cover your own accounts and gives a much better feel. David Gregory try a publisher with well over a decade out of knowledge of the fresh economic features globe.

Cellular view deposits

Payment could possibly get determine how and you may where items are available, as well as the buy inside the number classes. All of our objective is to gather the big information from varied source, giving an excellent cautiously curated alternatives that is one another related and current. When you’lso are sure the newest , produce “” to the view and make sure to help you ruin it. More resources for dating-founded advertisements, on the web behavioral advertising and our very own confidentiality techniques, delight remark the fresh Bank from The united states Online Privacy Notice and you may our very own On line Confidentiality Frequently asked questions.

Cellular take a look at deposit lets you add money to your family savings rather than visiting a department. Using your lender’s mobile application, you are taking photos of one’s front and back of one’s consider and you may fill in her or him for put. Capitalizing on the brand new mobile put element because of a lender’s app could save you some time and a trip to an excellent part. Make sure that the total amount you deposit doesn’t go beyond the lending company’s limit and you can hold any seek out a few days immediately after distribution it. You could potentially usually play with mobile deposit for checking and you will higher give offers profile, however some banks could possibly get limit which account types are eligible to own this particular service.

Banking

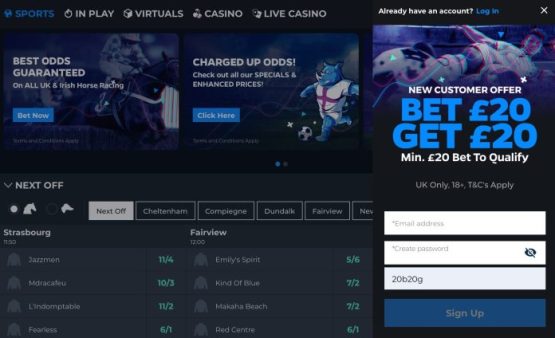

If you use which commission approach from the gambling enterprises, debt study stays secure, since you’re also circuitously sharing sensitive suggestions or banking facts to the gambling enterprise itself. Pay from the cellular also offers a safe alternative for on-line casino deals, offering participants additional satisfaction when creating money. The brand new transactions are processed via your smartphone vendor, which typically has powerful security features in position. As with any on the internet transaction, it’s vital that you play on legitimate gambling enterprise websites having the brand new appropriate permit and are controlled so that the higher amounts of protection and you may fairness. Mobile take a look at deposit will likely be a handy treatment for manage deposits in order to a verifying, deals otherwise money field account.

Investigate entire Gambling establishment Expert local casino databases and discover all of the gambling enterprises you can pick from. If you would like exit the options discover, this is basically the proper list of gambling enterprises for you. Get more advice on tips manage the mobile device of ripoff. Be sure to merely put a cheque immediately after, in a choice of people otherwise electronically.

Discover the account we would like to deposit on the and you will input the new look at count. You could potentially always come across your own financial’s cellular put restrict because of the signing into the on the internet bank-account otherwise getting in touch with your lender’s customer care service. The brand new cellular deposit restriction is typically placed in the brand new terms and requirements of your membership.

Including, place a light check up on a dark-colored dining table prior to taking the fresh images. Find the bank account where you wanted the fresh check’s money so you can be transferred. Monitors becoming transferred digitally should also end up being endorsed just as they are doing whenever getting transferred in person. Simultaneously, banking companies fundamentally require you to generate a note such as “to possess cellular put simply” using your signature. Cellular take a look at deposit defense integrate cutting-edge technology and conformity tips. Secure sockets covering (SSL) encryption protects research transmission between your member’s equipment and the financial’s server, ensuring privacy.

Certain child custody and other characteristics are offered by the JPMorgan Chase Financial, N.A good. JPMS, CIA and you may JPMCB is associated organizations under the preferred control over JPMorganChase. Examine the newest QR code in order to download the newest application understand exactly how to transfer currency to another checking account and you may experience shelter to the the brand new go.

Of a lot financial institutions render this particular service on the people but it’s tend to difficult to get aside exactly how much you could really deposit using your portable. For individuals who’re concerned with deposit inspections if you don’t acquiring an artificial take a look at, you could potentially consult percentage in the dollars or as a result of a fellow-to-fellow percentage program such PayPal, Venmo, Dollars Application, or Zelle. Transferring a check through your smart phone is easy and you may seems equivalent no matter which of the best federal banking institutions you financial which have. All largest banking companies from the U.S. have a similar mobile take a look at deposit processes. Mobile banking programs generate dealing with your bank account while on the fresh wade easy and simpler.

Obviously, you will probably have to find those individuals casinos you to definitely specifically undertake the selected cellular phone percentage means. You can do this from the ticking the appropriate container regarding the ‘Payment method’ section. And also the noticeable applicants such as Apple Spend, there are even particular team well-noted for devoted to local casino deposits, such as Paysafecard and you can Neteller. This makes consider places almost real-time and energy to where you are able to discover a check away from a pal, breeze a photograph to see the new pending equilibrium instantaneously. While you are there still was a short time’ lag time between after you put the brand new consider and when your own account’s balance theoretically transform, the process is swift and simple. You might deposit a cheque in the account from anywhere by the delivering a picture of it using an app on the wise cellular telephone otherwise pill.

- Various other advantage of spend because of the mobile phone expenses ports is that you have to give away relatively reduced private information in the profiles.

- The lender also can won’t award your own mobile look at put and you will refute their exchange.

- Of many banking institutions and you may borrowing from the bank unions, of varying sizes, offer cellular consider put.

- I explore all of our mobile phones to have all else, consider make use of them in order to deposit a, as well!

- It’s an easy task to believe you’ll have to have the current and best handset so you can spend through your cellular telephone from the an internet gambling establishment.

If your view visualize isn’t best (as well dark, fuzzy, otherwise forgotten sides), the newest application you will deny it. Which are an obstacle, specifically if you’re also looking to put to your a rigid agenda. SoFi Examining and you can Offers is a superb membership option for individuals who do not mind keeping your deals and you can examining in a single membership. Along with submission a photograph, banks tend to ask you to enter in the new look at number. If it cannot fulfill the quantity created to your consider — the numerals as well as the text — the put will be declined. After you log on together with your account, you are asked to confirm the name in a different way, for example by acquiring a code or hook up thru text or by the responding security questions.

If you wish to put a good traveler’s take a look at or a check from a different financial, you’ll want to go to a neighborhood part otherwise Automatic teller machine. Extremely loan providers, with the exception of on the internet banking companies, does not enable you to put this type of on the internet. Investment One users can also be’t cancel its cellular take a look at deposit just after it has been recognized. Most other banks might have certain assistance of cancellations, thus consult their customer support team more resources for your options.